How to Increase SaaS Customer Lifetime Value (CLTV)

Improve Your SaaS Growth Strategy for More Per-Customer Revenue

Matt Francois

CEO of SaaS Tune

For B2B SaaS companies, growing a customer base can be a delicate balancing act. On the one hand, you'll want to keep Customer Acquisition Costs (CAC) as low as possible. On the other hand, you'll need to maximize Customer Lifetime Value (CLTV) to ensure that you make a profit. Get this equation wrong, and you could go bust even while increasing revenue.

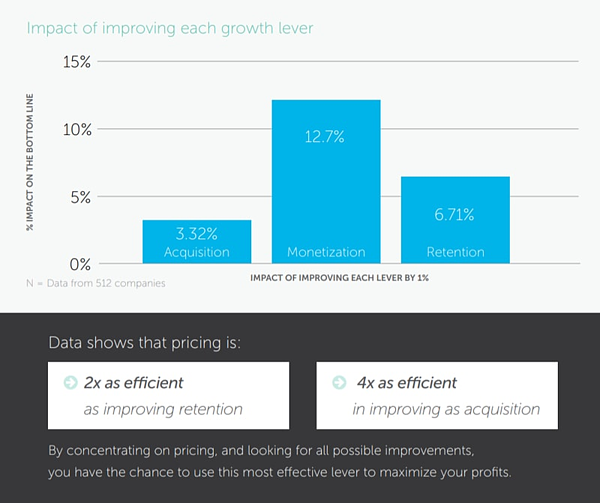

But which part of the revenue equation should you focus on first? According to a study from May 2020, the scales are balanced in favor of Customer Lifetime Value; improving monetization is four times as efficient as acquisition and twice as efficient as retention at helping SaaS companies grow.

Increasing per-customer value might be the secret weapon you need to accelerate your SaaS company's growth. So what do your per-customer metrics look like right now?

Critical SaaS Revenue Metrics

When calculating your per-customer revenue, you can use several different metrics at varying time scales. The first metrics we're interested in are Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR), but at the account-level, which yields Average Revenue Per Account (ARPA). If used properly, these measures can reveal the total value of a customer during their entire relationship with your company.

MMR normalizes annual and monthly subscriptions, while ARR lets you see your yearly financials. You need both, but just checking MRR and ARR can lead you astray.

What if you have a customer who makes a disproportionate contribution to monthly revenue — but only for three months? Or a customer who bumps up ARR for a year, replaced by another who does the same? In each case, recurring revenue is high, but lifetime value is low. A customer who makes an average ARR contribution for ten years is worth a lot more to your business. Still, you'll miss this when relying on broad revenue figures alone.

Since these figures are too vague to offer actionable insights, you'll need to dive deeper into your per-customer metrics. To do that, begin by dividing your MRR or ARR by your number of customers to see your ARPA:

MRR % customers = ARPATo get a glimpse of what ARPA can tell you, try comparing it to each of your customers individually.

If you're using the standard "three-tiers-and-custom-enterprise" SaaS pricing model, you'll likely find a small percentage of your customers accounting for a large percentage of your MRR. We're not necessarily talking Pareto levels, but don't be surprised if you find something close.

We're beginning to see data that can help us make decisions, but ARPA still doesn't tell the whole story. To learn more, we need to look at CLTV.

Calculating CLTV

CLTV is a vital part of a larger strategy for feeding data upstream to Customer Acquisition. Doing so allows you to determine which of your leads will become high-value customers and which you can safely disregard to save money. It also lets you see patterns in conversion and retention, letting you build flows to hold on to customers longer and grow per-customer value.

The typical formulae you see online for calculating CLTV use average purchase value, average purchase frequency, and average customer lifespan.

For example, suppose your SaaS company makes an average of $100 per purchase, average purchase frequency is monthly, and average customer lifetime is one year. In that case, each customer's lifetime value to your company is $1,200:

$100 x 12 months x 1 year = $1,200 Customer Lifetime ValueIn reality, an average lifetime of one year is pretty unlikely, as is a monthly payment. Monthly plans are offered on SaaS pricing pages, sure, and most B2B SaaS businesses provide both monthly and annual payment options. But annual payments are strongly incentivized, with higher-priced Enterprise plans often only available for annual prepayment.

So a more holistic way to calculate CLTV is this:

(ARPA x Gross Margin) % Customer Churn Rate

= CLTVThis improved formula factors in crucial information like how much money you're actually making per customer after your expenses and how quickly you're losing customers, all of which are vital metrics.

This is a critical formula that I mention often. For instance, I've shown you how to make the bottom number, churn rate, and smaller. I've also shown you how to drive up gross margins.

And now, you'll see how to increase the ARPA part of the equation.

Growing Average Revenue Per Customer

Fundamentally, you can grow your per-customer value by increasing the payment amount or payment duration, for example, by encouraging a $100 customer to pay $200 a month for a year or $100 a month for two years. Either way, the effect on CLTV is the same. Ideally, you want both.

Driving higher-priced sales is about perceived value, accurate pricing, and good sales and marketing. A lot of this is closely tied to your Pricing Model, so let's start there:

Pricing Model

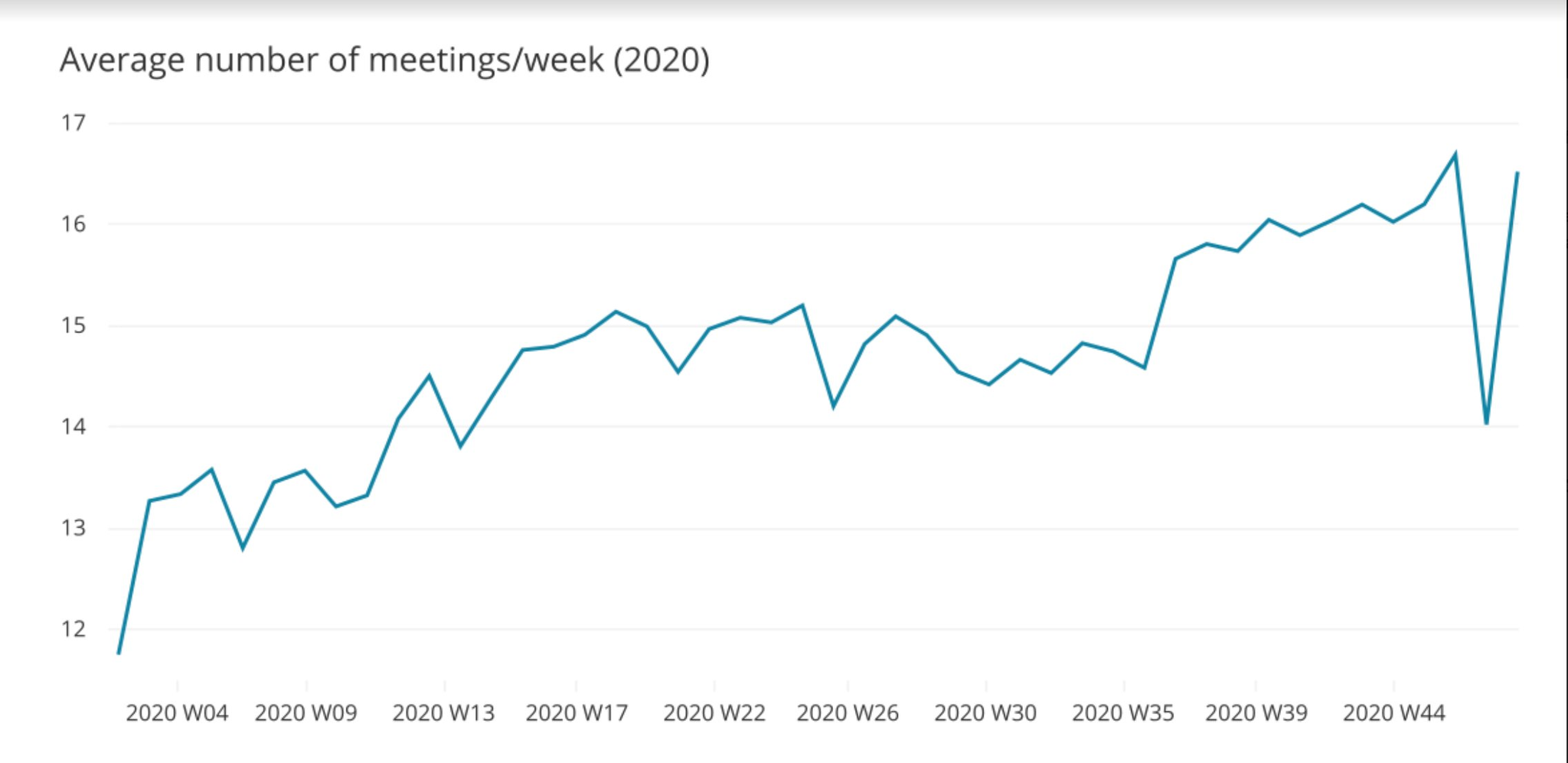

The average SaaS company spends six hours on pricing, in total. Most companies spend more time than that in meetings every week:

Your pricing model has a massive impact on your revenue, but it gets far, far too little attention.

SaaS suffers from a paradox. It's a space filled with companies seeking to be disruptive and unique, but it's also very conformist; ever notice how SaaS websites always tend to look the same? Far too many SaaS companies use the "what everyone else is doing, but a different color" approach to their pricing.

The result is that many SaaS companies borrow pricing curves wholesale from competitors as if there was no other alternative apart from guessing.

However, there is an alternative. You can't quantify your value to your customers with absolute precision, but you can get good ballpark figures relatively quickly.

Here's how to do that:

Value Curve

An inexperienced SaaS owner looks at product, distribution, and marketing costs, then adds their desired profit margin and calls that their price. This is pricing by cost, and it's one of the biggest traps SaaS founders encounter when establishing their pricing.

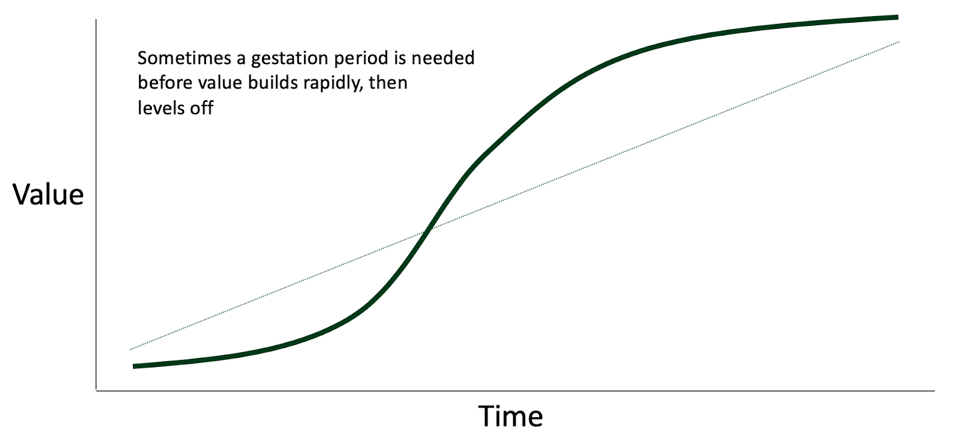

An experienced SaaS owner looks at the value the customer derives from their product and charges accordingly. To do that effectively, they need to discover their value to their customers and how the customer experiences that value over time — their value curve:

This curve illustrates when your customers experience the value your product delivers. For pricing to be effective, your billings should be tied closely to the moments when your customers experience value.

To draw a value curve that makes sense for what you're offering, you first need to identify your value metric(s) and cadence:

Value Metrics

A value metric is a metric that best correlates with where your buyer (not user) finds value in your product. Identify this, and it will tell you when to charge, how to cap tiers, and more.

For example, LinkedIn's main value proposition to its customers is that it lets you connect to people with whom you'd like to do business. If LinkedIn charged you to use the platform (per-seat pricing), it would destroy its value by disincentivizing usage. Instead, it charges for premium features like access to its data and private messaging, as well as sales enablement tools. This is where those who are willing to pay for LinkedIn find value.

Yet, the vast majority of SaaS businesses default to per-seat pricing. Is that their value metric? According to Price Intelligently's Patrick Campbell, eight out of ten such companies are charging sub-optimally.

For you, a better way forward is to figure out where your customers encounter your value, then establish an easily-trackable metric that works as a good proxy for that.

For instance, Wistia charges for bandwidth because that's a good proxy for viewer numbers, and "loads of people watched my video" is their big value proposition to their customers.

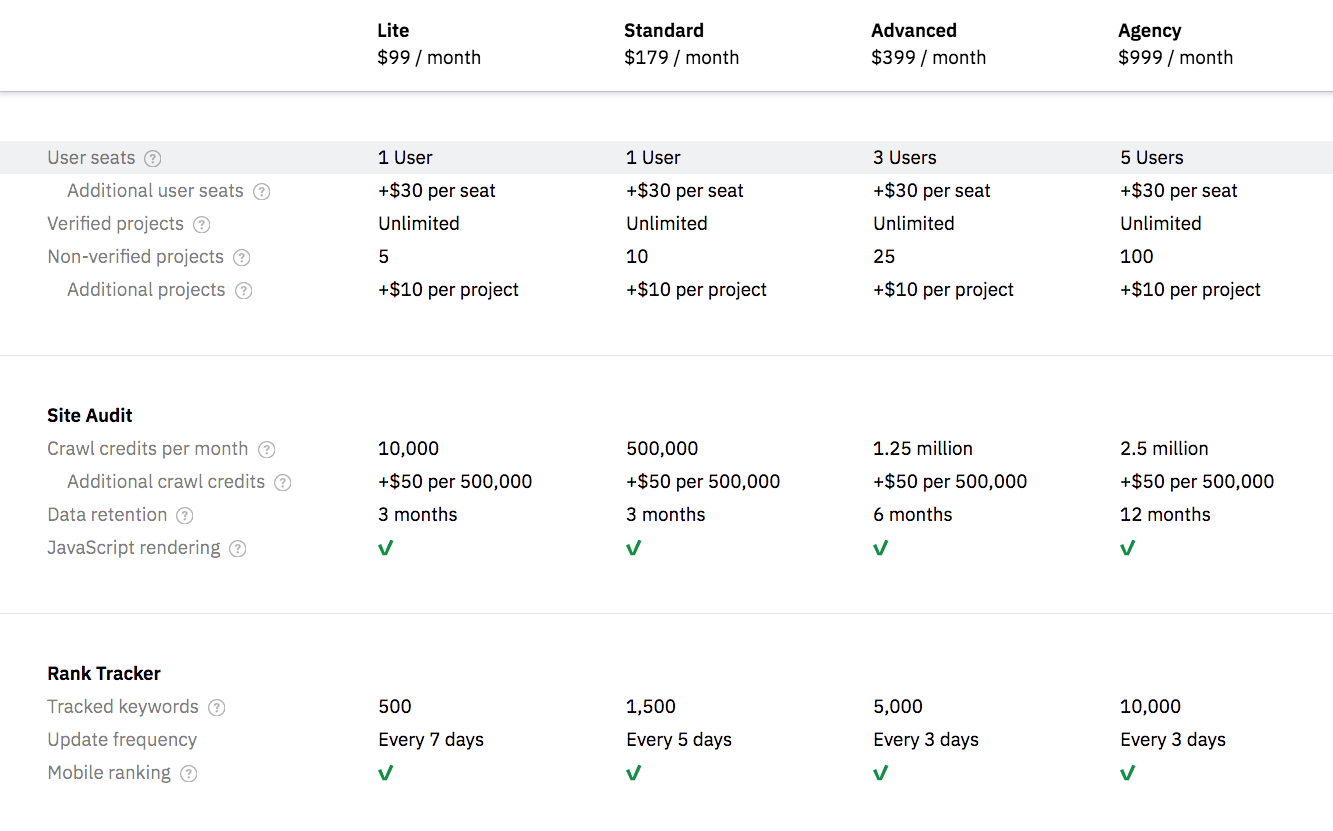

Here's how Ahrefs does it:

As plans go up in price, customers get exponentially more crawls, rank tracking, and data retention, as well as more enterprise-oriented features. Adding an extra user is a flat $30 across all plans because that's not what Ahrefs customers genuinely value.

Ahrefs knows their customers get value from their database and analysis tools. They don't get more value if the whole company can sit down and do backlink research simultaneously.

Before their acquisition, SaaS AI sales enablement platform OutboundWorks had this pricing page:

This pricing worked for them because if you're a sales organization with $10,000+ CLTV, you should just call them. If not, you wouldn't have the budget to benefit from what they offer.

So, just like these SaaS heavy hitters did, ask yourself, "What do my customers get out of my product?" The answer is your value metric, and that's what you should be using to develop your pricing model.

Value Cadence

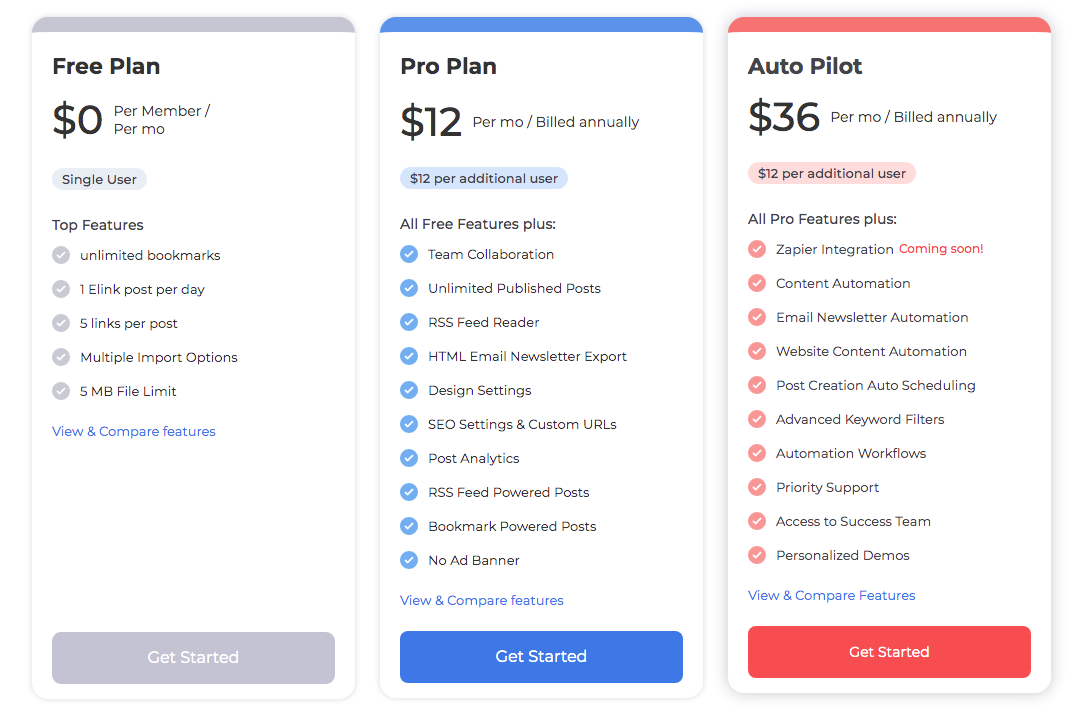

Let's say you're a tool like elink that lets users build content assets out of web links. So you charge, not by the number of users, but by features. That's because features are closer to what elink's customers value, not having everyone at the company use the product.

But how should you split your features up into plans to maximize revenue? Here's what elink actually did:

As you can see above, the first big bump in price is up to $12 per month. This plan lets you export HTML newsletters, collaborate with your team inside the app, and gives you unlimited published posts — up from a maximum of 1 per day in the free plan. In other words, if you're growing and you're using elink for your content engine, this is the point where you start getting serious about posting in volume and tracking how well posts perform.

This is value cadence: the phase, reason, or trigger that makes customers opt to move up a tier because they now will derive value from those additional features.

But how do you identify what exactly will make your customers pay more?

The best way to find out is to dig through your user data, offer surveys, get helpdesk and customer success to seek feedback, and interview customers. The more data you have on how your customers interact with your product, the better you can put an accurate price on the value they get from it.

Once you have a grip on your value metrics and value cadence, identifying exactly why and when your customers get value from your product is simple. The shape of your value curve will be apparent, and consequently, knowing what and when to charge will be a solved problem.

Pricing Page Design

Once you have a factual basis for your pricing strategy, it's time to encode it into a pricing page that sells. If there's one rule of thumb for pricing page design, it's to think of your pricing page as your most important landing page.

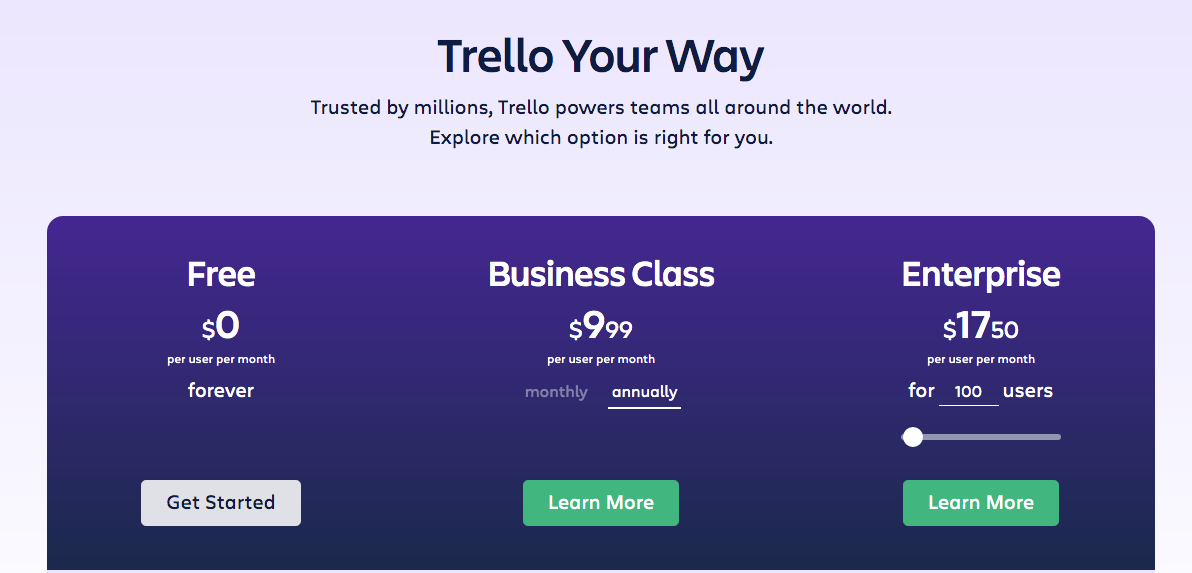

That means you'll want a clear value statement and Call to Action (CTA). For example, see Trello:

Trello wants to get everyone in your organization using the app, so it doesn't offer per-seat pricing. Instead, core features are free forever, and additional features and tools are paid for and rolled out for the whole organization.

Crucially, though, its value is clear from the top of the page, and it's obvious where to click to sign up.

Pricing Page Testing

Price pages can be A/B tested just like any other web page, and since they're crucial to your revenue and growth, it makes sense to test them often.

However, if you have little traffic or little data, A/B testing can result in changes that aren't statistically significant. For SaaS startups in this situation, you can optimize crucial metrics with significant yet straightforward changes and see if they work without the the need for complex multivariate tests.

But suppose your pricing and business are reasonably mature. In that case, you can do what Intercom did: Splitting paid traffic into two streams and dynamically aligning the copy served to one stream with the copy Google Ads served to search. Intercom got good results doing this, but they were well-established, with the expertise and budget to carry out complex testing on large traffic volumes.

Compare that with RJ Metrics' approach: faced with the need to "give visitors the information they need without overwhelming them with options..." and "avoid scaring away our core demographic while still showing the full range of companies that we can help," they added a pricing calculator to their pricing page that let visitors build a pizza. The result was a 310% increase in conversions.

Encourage Usage

A dependable pricing model and a high-converting pricing page aren't the only factors in improving per-customer revenue. Every SaaS company also depends on usage to grow.

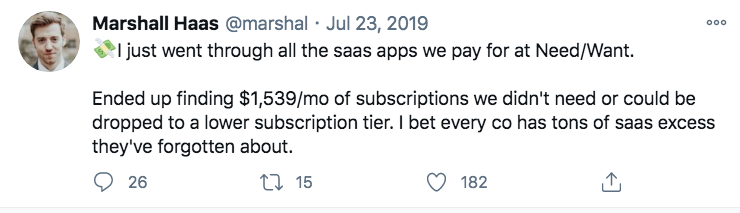

This concept should make intuitive sense. It's unlikely that you're going to sell your customers on a more valuable plan if they're not using the one they already have:

Most SaaS companies are carrying excess "zombie" subscriptions, messing with their retention and CLTV data, and ultimately sabotaging their growth.

Many subscriptions aren't being used because customers never got to the product's value. They signed up, didn't see a use for the product, and then forgot about it.

One way to prevent this situation from developing in the first place is to focus on onboarding, for extant and especially for new customers:

Onboarding

Onboarding is the process of walking users to value. When I log on to your app for the first time, do I know what I'm supposed to do?

Remember, customers don't view your product the same way your engineers and designers do. Think about logging into an app like Adobe Photoshop Express: if you're new to graphic design, you might think "What the heck does all this do?" Removing the background from an image or recoloring a graphic are both easy to do if you know where to look but impossible if you have no idea where to start.

Onboarding should start at signup — during it, not before it. Reduce the amount of required information to the absolute minimum. Don't think "What other data can we ask the user for?" Instead, think "Which form fields can we eliminate?"

Onboarding is a topic worthy of it's own article, so you can learn more about it here.

Reactivation

When users aren't logging in, it doesn't necessarily mean they've decided to leave. It could mean they don't need your offering right now. Maybe they're working on a project with different requirements but are planing to come back later.

But in the worst case, a disengaged customer could mean they aren't getting the value they need from your product. If that's the case, you can recover those users by reactivation.

Monitor user accounts and watch for dips below a certain usage threshold, one that your long-term customer data indicates is associated with churn. Reach out to these users via email.

This tactic seems simple, but there are pitfalls you'll need to avoid. I discuss more in-depth retention strategies here.

Key Takeaways

- Focus on growing per-customer value as the most effective method to accelerate sustainable growth.

- Price by value, not cost. Identify value curves and match price curves to them.

- Put significant effort into pricing strategy and pricing page design.

- Encourage app usage by onboarding and reactivation.

Share on:

Facebook /

Twitter /

LinkedIn /

Reddit /

Hacker News /

Email